Reading time: 6 minutes

IP Power: Licensed Brands as a Differentiator

China is strategically focusing on strong intellectual properties (IP) in retail – such as Hello Kitty, Pokémon, or local anime characters – to add emotional value to products across home, fashion, or FMCG. The exhibition “IP x Lifestyle & Home Products” at the Interior Lifestyle China trade fair in Shanghai exemplifies how IP is integrated as a design and experiential element into everyday life.

In Hong Kong, international pop culture icons such as Disney, Marvel, or Studio Ghibli dominate. Here, IP collaborations are less about mass appeal and more about premiumisation and differentiation – often combined with art, design, or limited availability. IPs thus become carriers of brand identity and emotion, infusing retail with cultural and experiential depth.

Interlude: What is IP, and Why is It Important in Retail?

“IP” stands for “Intellectual Property” – legal rights protecting creations of the mind. In retail, it typically refers to well-known, protected brands, characters, designs, or story worlds that can be commercially licensed. Common examples include Hello Kitty (Sanrio), Pokémon, Disney characters, Star Wars, or local cultural figures and artist brands.

Why are IPs important in retail?

- High recognition & emotional engagement

- Differentiation in a competitive market

- Storytelling & lifestyle positioning

- Targeted audience appeal

- Viral potential & social media impact

Content Commerce & Platform Marketing

In China, social media and shopping merge into a dynamic ecosystem: short videos, livestreams, and in-app purchases on platforms like Douyin, Taobao Live, or Xiaohongshu shape consumer behaviour. KOCs (Key Opinion Consumers) act as authentic micro-influencers with high credibility – often more effective than celebrities. Commerce becomes content – fast, entertaining, and interactive.

Hong Kong follows a more selective approach: platforms like Instagram or HKTVmall link e-commerce with locally rooted influencer marketing. Authenticity, relatability, and cultural relevance are key. Retail becomes a stage for storytelling, community building, and lifestyle expression – especially among design- and trend-savvy target groups.

Curated Pop-ups & Lifestyle Collaborations

In China, the point of sale becomes a staged experience: flash sales, time-limited pop-ups, and collaborations with artists or IPs create hype, exclusivity, and social media buzz. Retailers use these formats to test new products, build communities, and emotionally charge their brand.

Hong Kong takes a more curated retail approach with cultural depth. Spaces such as PMQ, K11 Musea, or The Mills combine shopping with design, art, and urban identity. Temporary retail formats focus less on mass appeal and more on curation, storytelling, and aesthetic experience – an approach that particularly appeals to creative and cosmopolitan audiences.

Premiumisation Through Design & Aesthetics

In China, design has become a status symbol – especially in home and lifestyle segments. Products are expected to be not only functional but also visually striking, often aimed at “Instagrammability”. Collaborations with museums, artists, or design platforms add cultural value and position products as reflections of personal style and social belonging.

SKP-S Beijing: Luxury as an Immersive Experience

A striking example of this trend is SKP-S Beijing: the luxury department store, opened in 2019, combines art, technology and fashion to create an immersive experience. With futuristic themed worlds, interactive installations and specially curated brand environments, SKP-S particularly appeals to a tech-savvy, younger audience. In this way, the luxury market in China is being redefined through innovative architecture and digital innovations – the shopping experience itself becomes a cultural stage and a symbol of the future of luxury.

In Hong Kong, design-sensitive, globally minded consumers value quality materials, refined design language, and curated presentation – particularly for interiors, gifts, and homeware. Retail becomes a gallery: aesthetics, storytelling, and lifestyle merge into a shopping experience that convinces through visual sophistication and international references.

Sustainability & Urban Eco-Living

In China’s Tier-1 cities like Shanghai or Shenzhen, sustainability is becoming a strategic imperative: CO₂-neutral logistics, recyclable packaging, and eco-friendly materials are becoming the standard – driven by regulation, shifting consumer behaviour, and an increasingly image-conscious urban middle class. Major retail platforms are particularly investing in green supply chains and climate-friendly retail concepts.

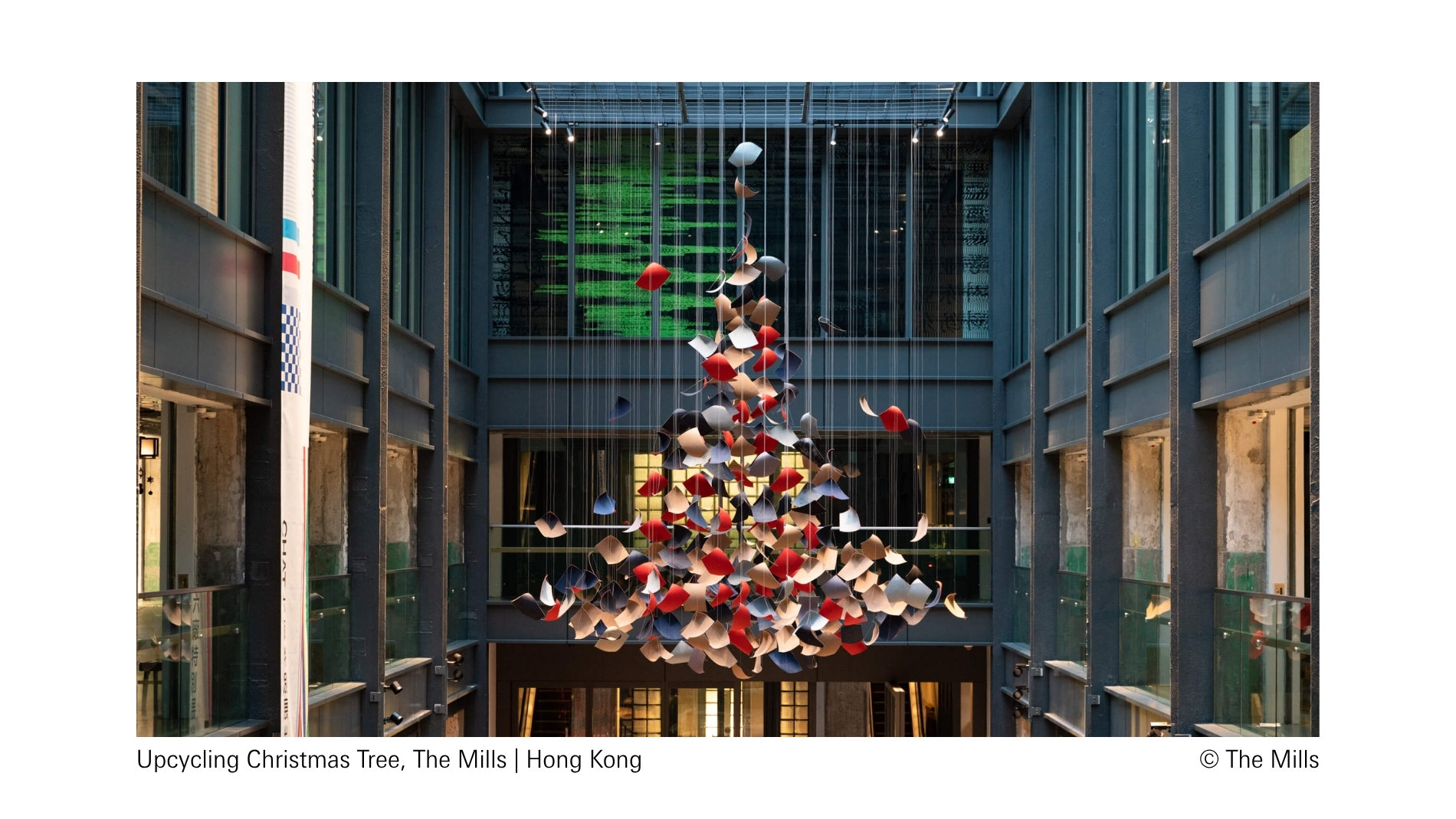

Hong Kong approaches sustainability from a lifestyle perspective: zero-waste practices, upcycled design, clean beauty, and eco-concept stores shape the urban scene. Formats like “refill bars,” plastic-free pop-ups, or sustainable brand collaborations strike a chord with a design-savvy, environmentally conscious target group. Sustainability is thus understood not only as an ethical imperative but also as part of an urban, aesthetically demanding lifestyle.

Tech & Smart Retail: Data-Driven & Personalised

China is pushing the boundaries of retail technology: AI-based store systems, cashierless check-outs, facial recognition, and real-time data analytics enable highly personalised shopping experiences – both online and offline. Major platforms like Alibaba and JD.com link user behaviour across systems to dynamically adjust product recommendations, assortments, pricing, and services. Smart vending machines and digital shop windows are also on the rise.

In Hong Kong, technology is introduced more selectively – mainly in premium or flagship formats. Automated fashion displays, interactive touchpoints, or sensor-based product experiences, such as those found in K11 Musea, are used not just for efficiency but to enhance brand experience and emotional engagement. Smart retail becomes a tool for delighting customers through aesthetic, convenience, and digital services.

Cross-Border Commerce & Export Orientation

China is increasingly positioning itself as a global retail hub – led by platforms like Temu, TikTok Shop, and Alibaba, which bring Chinese brands directly to international markets. Especially in home, lifestyle, and consumer segments, products are optimised for export – with appealing design, localised campaigns, and direct digital distribution. The D2C (Direct-to-Consumer) approach allows Chinese manufacturers to reach global consumers without traditional intermediaries.

Hong Kong serves as a strategic bridge in this ecosystem. With its free-market policy, duty-free status, and international outlook, it acts as a gateway for export brands aiming to enter the Chinese mainland or Southeast Asian markets. Trade fairs, logistics centres, and platforms like HKTVmall or regional distributors support cross-border trade – efficiently, scalably, and often faster than traditional export routes.

For many brands, Hong Kong serves as a test market with an international audience and a springboard for expansion into Greater China and beyond.

Business Incubators & Retail Start-ups

China is strategically investing in retail innovation: incubators and funding programmes in cities like Shanghai and Shenzhen support IP-based start-ups, direct-to-consumer brands, and digital store concepts. The aim is to accelerate market readiness and test new consumption formats.

In Hong Kong, a design- and impact-driven start-up scene is emerging – typically at the intersection of tradition, sustainability, and technology. Programmes like The Mills Fabrica combine co-working, lab infrastructure, and mentoring – with a focus on cultural relevance and social value in retail.

Culture & Heritage: Between Guochao and Global Contemporary

In China, “Guochao 2.0” stands for a confident return to cultural roots – with a modern twist. Elements such as Chinese calligraphy, traditional patterns, mythological motifs, or the Five Elements theory – a traditional Chinese colour system with cultural symbolism – are reinterpreted and translated into fashion, homeware, or packaging. This trend is not only aesthetic but also identity-building: especially younger audiences associate it with a sense of cultural pride and contemporary locality.

In contrast, Hong Kong gravitates toward a “global contemporary” style – a cosmopolitan, design-oriented approach that combines international currents, urban coolness, and cultural openness. This style is characterised by:

- Minimalist, high-quality design

- Cultural layering inspired by Western art, Japanese aesthetics, or Korean lifestyle

- Multicultural influences reflected in materials, form, and mood boards

- Collaborations with global brands, designers, or art institutions – often as pop-ups, limited editions, or curated retail spaces

Cultural heritage in Hong Kong is expressed more subtly – through architectural cues or narrative product concepts. Locations such as K11 Musea and The Mills exemplify how “global contemporary” works as a connector between tradition, innovation, and international identity.

Design Platforms & Art-Retail

In China, government-supported initiatives like Shenzhen Design Week or design-led concept malls promote synergies between industry, design, and consumption. These platforms support innovation, aesthetic education, and market-ready product development – especially in the living and lifestyle sectors.

Hong Kong follows a more curated approach: institutions like K11, The Mills Fabrica, or Art Basel create immersive environments where art, culture, and retail converge. Design is staged as emotional value – through rotating exhibitions, collaborative product lines, or immersive store formats. Art-retail not only drives differentiation, but elevates retail as a cultural platform.

Conclusion: Retail Trends in China & Hong Kong – A Dynamic Future Outlook

The retail trends from China and Hong Kong show a clear picture: China remains a powerful innovation engine with a focus on tech and IP, while Hong Kong shines as a curated, design-driven retail stage. Trends like content commerce, smart retail, IP integration, and design-driven shopping are not only shaping the Asian market, but are increasingly relevant for international retail strategies as well.