Reading time: 6 minutes

Omnichannel & Live-Commerce

Retail in Japan takes a technological yet structured approach: QR code shopping in shop windows, digital in-store advice, and smart checkout systems offer a calm, service-focused omnichannel experience. The emphasis is on seamless transitions between online and offline. Physical retail space remains important and is enhanced – not replaced – by digital interfaces.

South Korea has built a highly networked retail ecosystem in which mobile shopping, social commerce, and livestreaming fully converge. Platforms such as Naver Shopping Live or Kakao Live create smooth transitions from inspiration and consultation to purchase – all mobile, interactive, and in real time. The majority of online revenue now comes from social commerce, significantly boosting the importance of a strong digital brand presence.

This is also reflected in the market’s rapid growth: According to the Research Center at Kyobo Securities, South Korea’s live commerce market grew from approximately KRW 400 billion (around USD 300 million) in 2020 to KRW 6.2 trillion (approx. USD 4.4 billion) in 2022. For 2023, it was projected to surpass KRW 10 trillion, equivalent to roughly USD 7.6 billion.* (Source: Korea Financial News, 2023)

Sustainability & Ethical Consumption

In Japanese retail, sustainability is deeply rooted in the culture, but expressed more subtly: the focus is on longevity, repairability, and resource conservation. Materials like LIMEX – a mineral-based plastic alternative – and recycling initiatives by established brands (e.g., Patagonia) exemplify a growing yet understated awareness of sustainability. Here, sustainability is understood as an internal attitude rather than a marketing message.

South Korea's green retail is more assertive: zero-waste stores, refill concepts, and sustainable packaging solutions are gaining increasing market share (2022: approx. $11.3 billion in revenue). These concepts often come with transparent communication around origin, supply chain, and carbon footprint. Younger consumers in particular now expect sustainable brand values as a standard. According to a 2024 study by the Korea Chamber of Commerce and Industry (KCCI), over 64% of consumers aged 20 to 39 prefer products from brands offering sustainable packaging and transparent supply chains.

Content- & Influencer-Marketing

Retail in Japan favours authentic storytelling centred on regional values and personal relationships. Rather than rapid product placement, the focus is on community connection. Influencers serve less as advertising channels and more as bridges between brand and daily life – with an emphasis on trust, continuity, and cultural relevance. Brand communication is narrative-driven, understated, and strongly localised.

South Korea, by contrast, operates a complex, highly developed KOL/KOC (Key Opinion Leader/Consumer) ecosystem, where influencers are systematically integrated into sales strategies. Particularly effective: micro-influencers who launch products within seconds via TikTok or KakaoTalk and drive them directly into retail. Brands rely on data-driven campaign management, real-time monitoring, and personalised content.

Premiumisation & Quality

Retail in Japan focuses on quiet quality: traditional craftsmanship – for example from regions like Tsubame-Sanjo or Kyoto – is closely tied to cultural identity. Wabi-sabi, the concept of beauty in imperfection, influences not just product design but also brand identity. High-quality, long-lasting products are expressions of lifestyle, ethics, and mindfulness – not prestige.

In South Korea, premiumisation is driven by innovation: particularly in beauty and lifestyle, new product worlds emerge that differentiate through high-tech, design, and exclusivity. Personalised cosmetics, innovative textiles, and smart fashion show how technology can be emotionally staged.

Experience-Driven Retail & Tech Integration

Retail in Japan follows a calm but technologically ambitious path. Robotics, digital signage, smart shelves, and virtual fitting rooms enhance efficiency and service. Technology is not an end in itself, but a quiet engine for an improved shopping experience – aimed at guidance, comfort, and personalised advice.

South Korea stages the point of sale as an experiential space: pop-up stores with AR elements, AI-powered consultations, and cashierless stores turn shopping into an event. In urban centres like Seoul, retail is part of a cultural leisure landscape that blends shopping, entertainment, and community.

Digitalisation & Cashless Society

Retail in Japan is catching up noticeably: the proportion of cashless payments reached around 43% in 2024 – and continues to rise. Younger people and tourists are driving this trend. The government actively supports the expansion of NFC and QR payment, encouraging even small retailers to adopt digital payment options. Security and user-friendliness are key.

South Korea, meanwhile, is digitised right down to the receipt: mobile payments via apps like KakaoPay or Naver Pay are fully standard. Customers expect not just speed, but also bonus programmes, personalisation, and a various payment methods directly integrated into the shopping process.

Pop Culture & IP

Retail in Japan is heavily influenced by anime, manga, and character licences, which drive visual and emotional storytelling. Cult figures like Doraemon, Totoro, or Gudetama are more than merchandise – they represent collective pop culture. Collecting plays a central role: limited editions, blind boxes, or retail events encourage brand loyalty through cross-generational emotional connections.

South Korea’s cultural export thrives on iconic IPs: K-pop, webtoons, eSports characters, or K-drama figures are strategically integrated into fashion, accessories, and product lines. Collaborations with international brands create global visibility and cultural capital transfer.

Lifestyle & Wellness

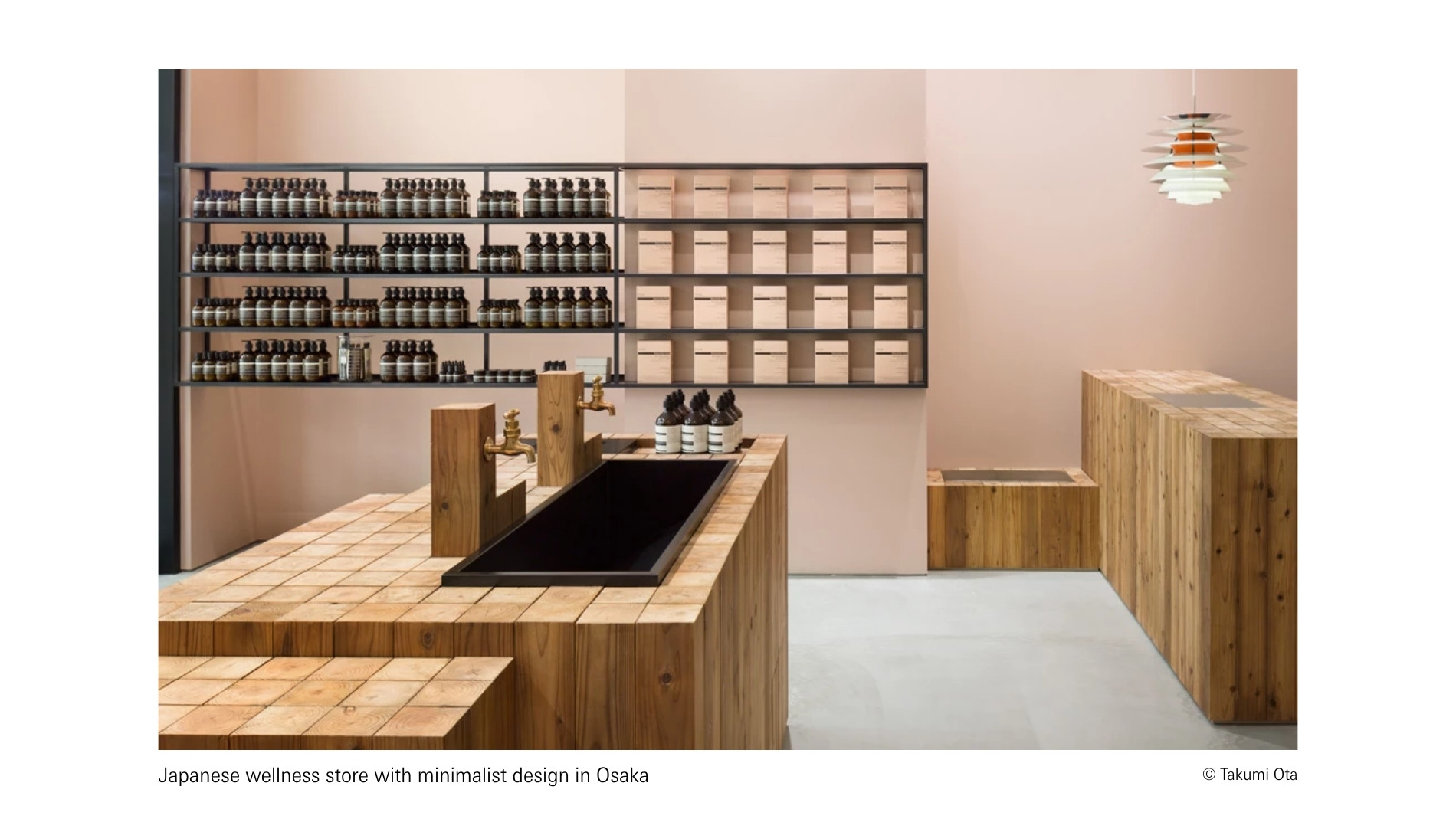

Retail in Japan interprets wellness in a more restrained way than its neighbour: through minimalism, mindfulness, and a functional lifestyle. Products are designed to create space for calm, structure, and physical well-being. Particularly popular are multifunctional, subtle items for the bathroom, kitchen, meditation, or sleep – all high quality and minimally designed.

South Korea combines wellness with technology: smart mirrors, personalised skin analysis tools, or wearables for monitoring sleep and stress are setting new standards in self-care. Retail is evolving into a high-tech wellness platform, supported by data analytics and app integration.

Cross-border Commerce & Globalisation

Retail in Japan follows a value-based globalisation strategy. High-quality products – especially in interiors, food, or paper goods – are selectively exported to markets that value authenticity, cultural depth, and craftsmanship. The emphasis is on selective partnerships over volume, with brand identity at the core of the export strategy.

South Korea, on the other hand, has become an agile export powerhouse: K-beauty, lifestyle, and fashion are distributed globally via platforms such as Coupang, Gmarket, or Qoo10. The strategy: fast, digital, and trend-focused. Brands use online channels to test new markets before expanding with a physical presence.

Business Incubators & the Start-Up Scene

Retail in Japan provides targeted support for design and tech start-ups – especially those bridging tradition and innovation. Funding programmes, local design weeks, and retail labs help entrepreneurs test new ideas – from smart packaging and IoT solutions to reimagined artisanal products. Innovation is viewed as a process of continuous development, not disruption at any cost.

South Korea has an agile, government-supported start-up landscape in retail: incubators support emerging brands in beauty tech, D2C, and urban lifestyle, with a strong focus on scalability and platform compatibility.

Conclusion: Retail in Japan & South Korea in Transformation

Both markets demonstrate: Asian retail is complex, technologically advanced, and culturally rooted. While South Korea impresses with dynamism, tech, and pop culture, Japan relies on depth, sensibility, and sustainable differentiation. For international brands, both markets offer valuable insights – as sources of innovation and blueprints for the future of retail.