Reading time: 10 minutes

Retailtainment: When Shopping Becomes an Experience

Gulf States:

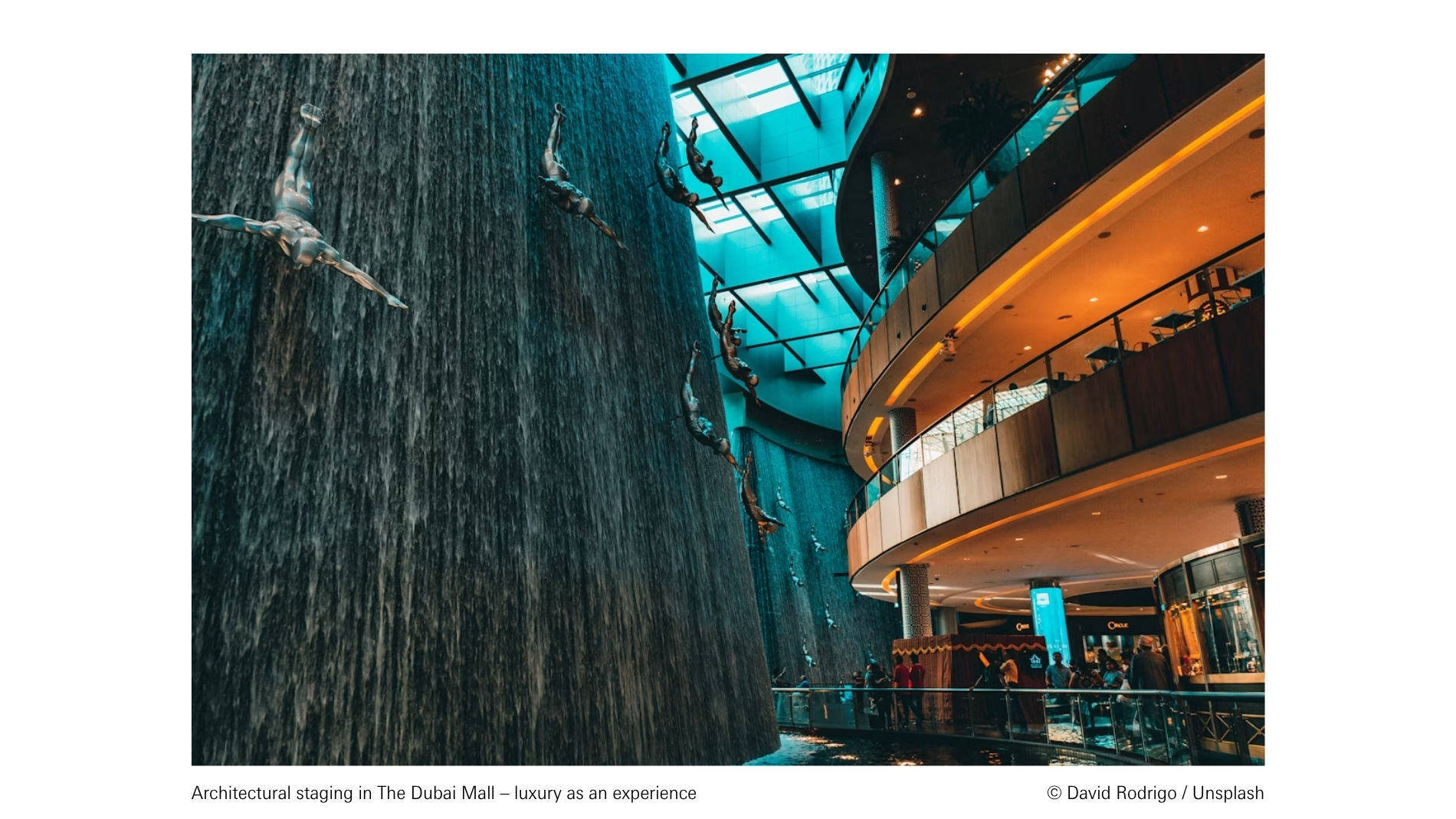

Shopping malls in the UAE or Saudi Arabia have long since become more than just retail spaces. They blend retail with art, entertainment, gastronomy, culture, and education. Examples of such shopping & experience worlds:

- Dubai Mall: a globally leading shopping destination with over 1,200 stores, a waterfall, aquarium, and luxury district

- Dubai Festival City: over 230,000 m² with around 400 retail stores, restaurants and entertainment venues, plus a large programme of cultural events

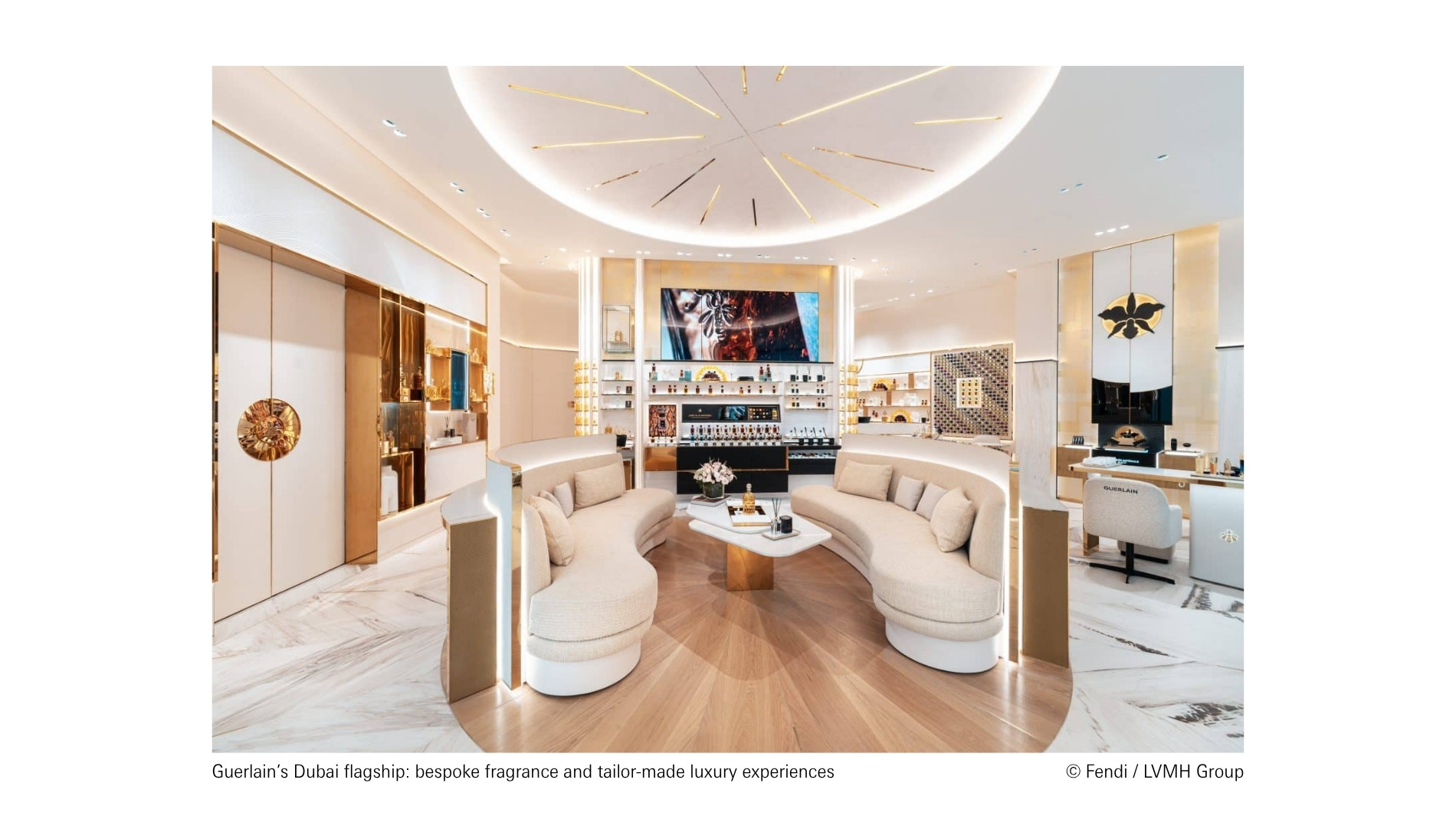

Architectural staging in The Dubai Mall - luxury as an experience

Other countries:

In Turkey and Egypt, mixed-use concepts such as Istanbul’s Zorlu Center or Cairo Festival City are emerging, placing stronger emphasis on consumption rather than spectacle.

The Zorlu Center in Istanbul offers a premium shopping experience along with restaurants, a hotel, and even residential accommodation. The Cairo Festival City district, by contrast, is built around shopping conjunctions with entertainment and event spaces.

E Commerce Meets Offline: Omnichannel on the Rise

Gulf States:

In the UAE and Saudi Arabia, e commerce is long more than just a digital sales channel. It is a central component of a connected retail system that merges digital touchpoints with physical retail experiences. Platforms like Amazon.ae, Noon or Namshi offer Click & Collect, same day delivery, digital customer advice, loyalty programmes and mobile payment options which are often seamlessly tied to physical retail outlets.

Major retail brands and malls are responding with dedicated online pick up zones, in app store maps, digital shop windows or hybrid formats where the shopping experience begins in store and continues online – or vice versa. Particularly innovative is the “store-as-logistics-hub” approach, where brick and mortar shops function as local fulfilment nodes for online orders. Saudi Arabia’s Vision 2030 and investment in smart city infrastructure are actively driving such developments.

Other countries:

In nations such as Jordan, Egypt or Lebanon, omnichannel retail is still in earlier stages of development. E commerce is growing rapidly but is not yet widely integrated with physically based retail. Platforms such as Jumia or local providers like Carrefour Egypt online are steadily expanding their logistics and payment infrastructure, yet in many places standardised links between online and offline remain lacking.

Challenges include:

- Less widespread adoption of digital payments (cash remains dominant)

- Logistical bottlenecks outside metropolitan hubs

- Lack of integration between marketplace, warehouse, and physical retail

- Limited manpower and technological resources in the retail sector

Nevertheless, progress is visible: mobile shopping apps are becoming more popular, social media (especially Facebook and TikTok) are increasingly being used for commerce, and international retail chains are piloting omnichannel models in cities like Cairo and Amman. The major potential lies in a young, digitally savvy population with increasing expectations for convenience, transparency, and hybrid shopping experiences.

Premiumisation & The New Concept of Luxury

Gulf States:

In markets such as Dubai, Abu Dhabi or Doha, luxury is part of everyday life – visible in flagship stores, bespoke shopping experiences, and five star service standards. Customers expect not just exclusive products, but emotionally charged brand spaces: scent personalisation, private fitting suites, high end gastronomy in store or AR powered product presentations are becoming standard. Luxury brands like Louis Vuitton, Dior or Hermès experiment with locally inspired editions or store architecture to combine cultural inclusion and status promise.

Other countries:

In Istanbul, Tel Aviv or Beirut, premiumisation is expressed less through glamour and more through design culture, craftsmanship, and originality. Brands rely on story driven branding, local materials, minimalist aesthetics or sustainable production methods to distinguish themselves from globally standardised luxury concepts. Consumers here seek uniqueness rather than icon status, for example through limited art collaborations, curated boutique formats or modern interpretations of traditional craftsmanship.

Smart Stores & Retail Tech

Gulf States:

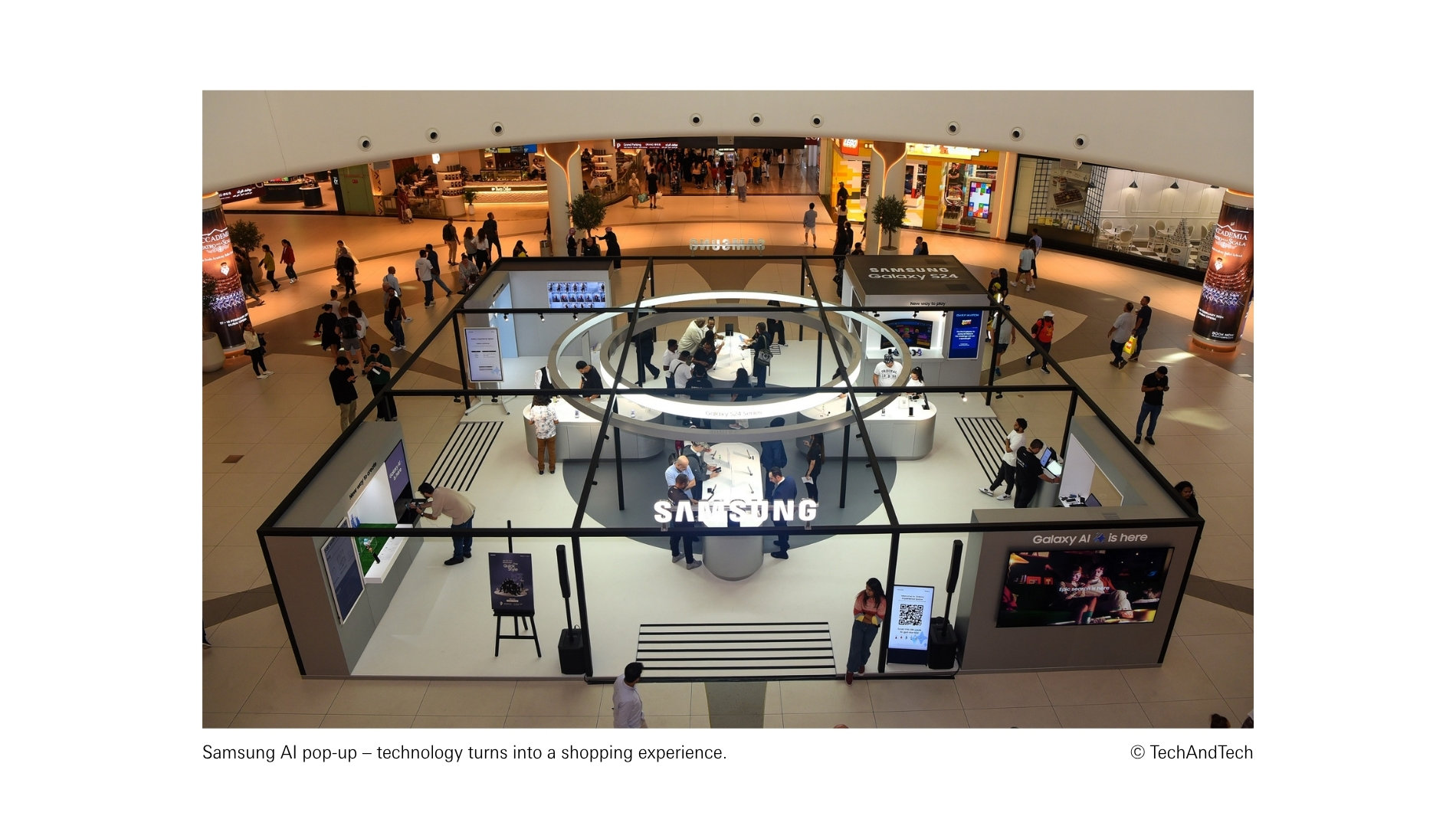

In the Gulf States, physical retail is increasingly considered a technological platform. Riyadh and Dubai are testing AI driven assortment logic, interactive screens, facial recognition in loyalty systems and fully cashierless stores inspired by Amazon Go.

In Abu Dhabi especially, retail is closely linked with the smart city vision: sensors, real time data and digital services integrate seamlessly into urban development, logistics and customer loyalty. Malls are becoming data driven ecosystems where every visit is analysed, optimised and personalised.

AR experiences redefine Dubai’s luxury retail © Artsun Studio

Other countries:

Israel is considered a hotspot for retail tech innovation. Start ups there are developing solutions for predictive shopping, automated inventory optimisation, intelligent payment integrations and retail AI platforms used globally.

In Egypt and Turkey, first pilot formats are emerging – AR mirrors, app based stores or virtual shelf extensions, mainly in fashion and beauty. The digitalisation is not yet pervasive, but there is significant innovation potential in urban clusters.

Pop up Culture & Curated Formats

Gulf States:

In the Gulf States, pop up culture is part of a consciously curated experience economy. Particularly in Dubai, Abu Dhabi, or Doha, brands use temporary formats to generate desirability and make brand worlds physically tangible. Venues like beach clubs, hotel lobbies or high end malls become stages for pop ups – often accompanied by influencers, live performances or limited editions. Theme formats such as “Local Art Meets Luxury Fashion” or collaborations with design universities from the region are popular.

Example: The “Concept Big Brands Carnival” in Dubai regularly brings pop ups of international premium brands to changing locations – with a strong focus on outlet staging and eventisation.

Other countries:

In Amman, Cairo, or Beirut, pop up formats often stem from the local creative and entrepreneurial scene. They are usually smaller, but deeply culturally rooted – for example as platforms for slow fashion, regional cuisine or craftsmanship. Places like Art Lab Studios in Beirut or The GrEEK Campus in Cairo regularly provide pop up space for young labels that prefer not to commit long term to retail. Many of these concepts evolve into semi permanent shops, design markets or seasonal micro malls.

Retail as Cultural Ambassador

Retail in the Middle East is increasingly becoming a canvas for local identity. Particularly in Saudi Arabia, Oman, or Bahrain, store designs employ:

- Arabian typography

- Regional materials like palm wood

- Traditional colours & patterns

- Thematic collections for Ramadan or Eid

Even international brands are adopting these codes more frequently – as symbols of cultural sensitivity and local relevance.

Sustainability: From Niche Topic to Demand

Gulf States:

Even in the Gulf States, sustainability is gaining real importance, especially in the context of innovation, brand profiling and urban development. While the mass market remains relatively price sensitive and less focused on sustainability to date, in the premium segment ESG (Environmental, Social, Governance) concepts are increasingly becoming a point of differentiation.

A pioneering example is Dubai Sustainable City, an ecological model district with solar power use, water recycling systems and low emission mobility solutions. Here, lifestyle, technology and environmental awareness merge into a forward looking retail ecosystem. First steps are also visible in the retail landscape:

- Refill offerings in beauty and household sectors

- Recyclable or biodegradable packaging

- Circular economy concepts in concept stores and boutiques

- Brand collaborations with sustainable fashion labels, such as limited collections with eco focus

A rising share of “Conscious Beauty” in the GCC is also a signal of change: consumers are increasingly attentive to ingredients, origin, and transparency.

Other countries:

In cities such as Tel Aviv, Istanbul or Cairo, sustainability is not only a trend but increasingly an expression of cultural attitude. Particularly urban middle classes and creative scenes emphasise conscious consumption, fair production and local origin. Notable initiatives include:

- Green fashion labels focused on upcycling, zero waste or socially responsible manufacture

- Organic and urban markets foregrounding regional products

- Community based platforms for sustainable lifestyles – e.g. Repair Cafés, clothes swap events or sustainability markets

- Digital transparency tools enabling consumers to learn more about supply chains and carbon footprints

Examples include projects such as “PopLove” in Tel Aviv, which links fashion with social empowerment, or OhSevenDays in Istanbul, which translates traditional textile techniques into sustainable design lines.

Influencers as a Sales Channel

Gulf States:

In the Gulf States, particularly in the UAE, influencers are already an integral part of the retail marketing mix. Social media platforms like Instagram, TikTok and Snapchat serve not only as reach channels but as active points of sale. Live commerce streams, real time product presentations and pop up events featuring influencer presence provide direct purchase impulses.

- Instagram content has grown by about 4.25% in the UAE influencer scene over the past five years, and TikTok is rapidly gaining prominence.

- The region is increasingly developing into a professional influencer ecosystem, supported by government incentives such as an AED 150 million fund for content creators.

Other countries:

In Egypt and Jordan, micro influencers are gaining prominence, particularly as credible voices with strong local roots. They act less as mere amplifiers and more as community connectors: approachable, committed and with tangible influence over local buying behaviour.

For many regional brands, they are central multipliers, particularly when it comes to authentic storytelling and placing culturally or region specific products. Platforms such as Favikon or Hypetrace regularly list the top 20 micro influencers per country – a growing pool of strategic partners for locally differentiated retail.

Their strength: genuine closeness to the audience, high credibility and organically grown followings make them effective brand ambassadors beyond major metropolises.

Tourism & Retail: Flagship Experience

Gulf States:

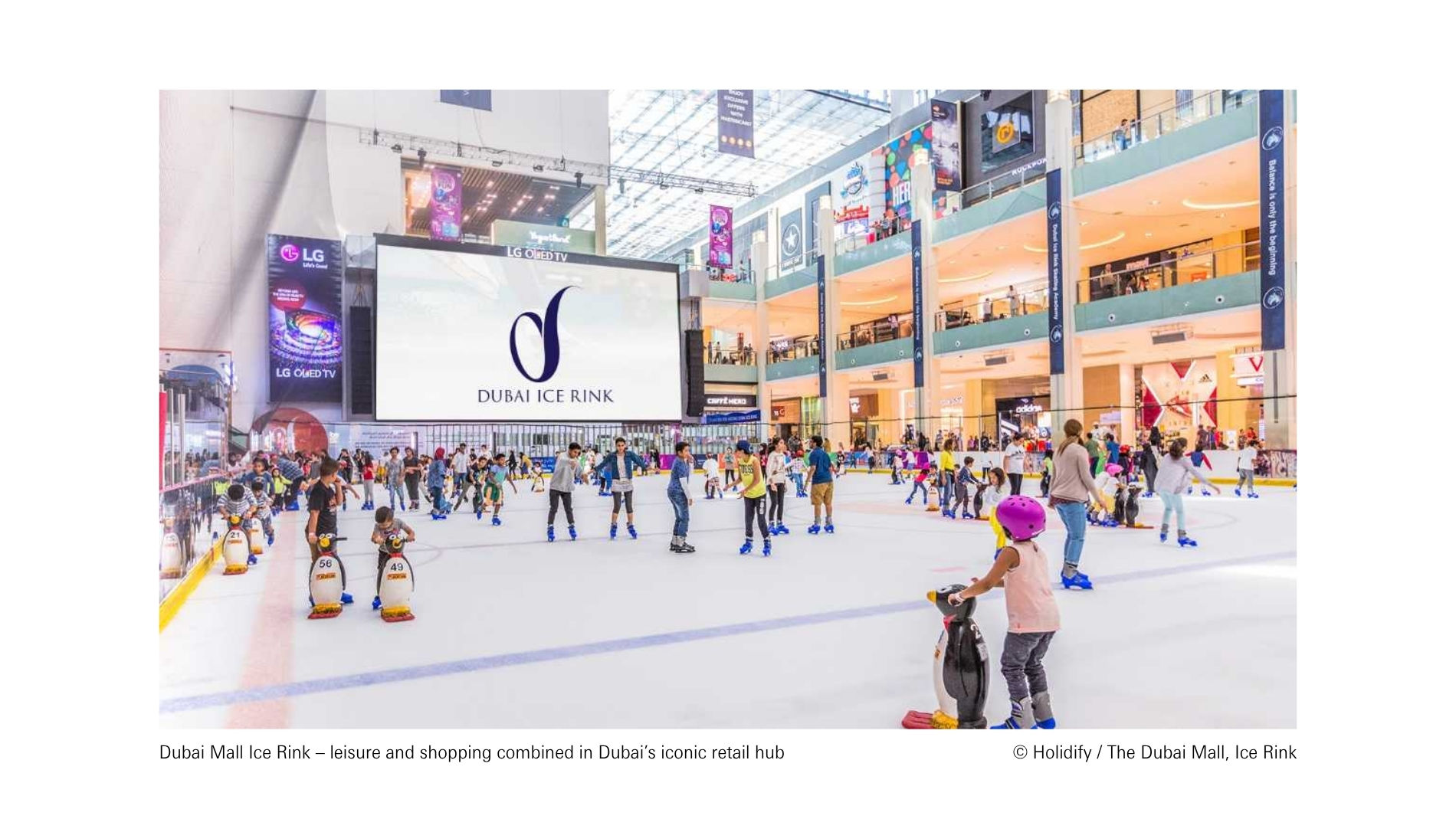

In the Gulf States, retail is long since not simply a part of daily life – it is an essential aspect of the tourist experience. In Dubai alone in 2024, the city recorded 18.72 million international overnight visitors, an increase of 9% from the previous year. Under such conditions, retail destinations like the Dubai Mall become experiential stages with built in ice rinks, aquariums, fashion events and not just shopping, but pure entertainment.

Dubai Mall Ice Rink – leisure and shopping combined in Dubai’s iconic retail hub © Holidify / The Dubai Mall, Ice Rink

Doha Festival City is also far more than a shopping centre: with over 500 shops, more than 100 restaurants and leisure attractions such as “Angry Birds World”, a 4DX cinema and an indoor snow centre, it delivers multisensory retail experiences. As part of Saudi Arabia’s Vision 2030, retail and cultural districts like Diriyah Gate are emerging in Riyadh that blend shopping, culture and landscape.

Flagship retail thus becomes central to tourism. Together with tourism, flagship stores evolve into strategic experience venues, where retail, architecture, and staging are deliberately used to foster customer loyalty.

Other countries:

In cities like Cairo, Istanbul or Amman, physical retail is closely tied to the tourism sector, though in a different form. There, souvenir shops, local craft markets and bazaar formats remain prominent within an urban familiar setting.

However, increasingly curated, experience oriented retail approaches are also emerging: Cairo Festival City, for example, combines shopping with culture and event spaces. And in Amman, the Amman Design Week organises temporary retail spaces such as a Crafts District, where local design and craftsmanship are merged into deliberately crafted consumer experiences.

These developments mark a gentle transition towards retail concepts with deeper cultural anchoring, though less designed as spectacle, more as part of urban identity.

Innovation & Support for Start ups

Gulf States:

In the Gulf States, state initiated programmes are transforming retail innovation into a strategic investment area. A key player is Hub71 in Abu Dhabi, founded in 2019 under the Ghadan 21 initiative. Hub71 offers start ups a tech intensive ecosystem with infrastructure, investment incentives and global networking. In the first half of 2025, 13 new AI start ups were admitted, raising the number of AI based companies to 53 – a clear signal of Abu Dhabi’s ambition to become a global AI hub.

Meanwhile, the Misk Accelerator (Riyadh) has taken a key role in Saudi Arabia’s start up scene: a twelve week zero equity programme, which since 2019 has supported over 170 start ups and continues to grow with nearly 20 participants per cohort.

Other countries:

By comparison, countries such as Israel, Turkey, and Jordan feature in retail innovation in different ways. Israel is considered a leading hub for retail technology: many start ups there develop solutions for predictive analytics, payment platforms or retail AI that are used globally. This innovative strength comes less from state programmes and more from established tech clusters with export relevance like those in Tel Aviv.

In Turkey, a growing number of young ventures are emerging in design, D2C and sustainable fashion, often initiated by creative founders. They are supported by local incubators, coworking spaces or stage formats, though without the institutional focus found in the Gulf States.

Conclusion: Middle East Retail in Transition – Locally Rooted, Globally Oriented

Retail in the Middle East is experiencing profound change, driven by technology, tourism, consumer culture and urbanisation. While the Gulf States are leading in investment into mega projects, luxury formats, retail tech and curated experience spaces, markets like Turkey, Israel, Jordan or Egypt are evolving toward culturally influenced, community focused retail concepts.

Key features of the region include:

- A close integration of tourism and retail (especially in the UAE & KSA)

- A dynamic premiumisation that emphasises experience, design, and storytelling beyond just product quality

- The rise of mobile, digital ecosystems, where wallets, social commerce and super apps shape daily life

- Support for start ups close to retail, which in tech centres like Abu Dhabi or Tel Aviv are developing pioneering solutions

Retail in the Middle East remains a mosaic: technological ambition meets traditional markets, global brands engage with local creators, urban giga malls juxtapose with creative pop ups. The region is not a homogeneous future market, but a highly compelling space for retail innovation with strong cultural character and growing international relevance.

Frequently Asked Questions about Retail Trends in the Middle East

What role does e-commerce play in the Middle East?

Online retail is expanding rapidly. Driven by a young, tech-savvy population and high smartphone penetration, shopping habits are increasingly shifting online. Countries such as the UAE and Saudi Arabia are leading the way. Online grocery shopping – often referred to as quick commerce – is also booming, as consumers place growing value on convenience and fast delivery.

What does “mall culture” mean for brick-and-mortar retail?

Although e-commerce is on the rise, mall culture remains a central part of social life in the Middle East. Shopping centres are not only places of consumption but also important meeting points for families and friends. Retailers therefore need to adopt a convincing omnichannel strategy that seamlessly connects the digital shopping experience with physical retail spaces.

How are consumers in the Middle East evolving?

Consumers in the region are becoming increasingly discerning. They are more price-conscious and less brand-loyal than in the past, yet they continue to seek high-quality shopping experiences. Key trends include:

- Convenience: Speed and simplicity are crucial in online shopping.

- Health & sustainability: An expanding consumer group is paying attention to healthy food and sustainably produced goods.

- Personalisation: Shoppers expect tailored offers and experiences that meet their individual needs.

- Digitalisation: Mobile use dominates; customers expect technologies such as AI and VR to be integrated into the shopping journey.

Which sectors are growing most strongly in the Middle East?

- Food and beverage (F&B): A dominant part of the retail landscape, especially through online grocery sales and the popularity of out-of-home dining.

- Luxury goods and lifestyle products: Despite some price sensitivity, demand for luxury and premium items remains strong. The region is a key market for international luxury brands.

- Electronics and fashion: Both sectors are seeing significant growth, fuelled by e-commerce and a preference for modern, tech-enabled products.

What challenges do retailers face in the Middle East?

- Competition: The market is becoming increasingly competitive, with both local and international players expanding their presence.

- Logistics: Last-mile delivery remains a challenge, as consumers expect ever-faster fulfilment.

- Payments: While digital payments are growing, cash-on-delivery is still common in some areas, complicating logistics and operations.

- Economic uncertainty: Inflation and other macroeconomic factors can affect consumer purchasing power.